Industry adoption: Who is using Document AI in financial services and how?

Document AI is a faster, cheaper and more reliable way to extract data and insights from documents. Companies have more data at their disposal than ever before, and Document AI is becoming the go-to solution for financial services firms who need to understand and analyze diverse types of documents at scale. But who is benefiting from using this technology and how?

Any business handling large volumes of documents can benefit from the technology, but banks, asset managers, insurers and credit funds are seeing a significant return on investment. These firms need a solution that can automate cumbersome and costly existing processes as well as extract and structure data they’ve been unable to access and analyze in the past. The capabilities of the platform mean it can handle virtually any text-heavy document and gather data points for any use case or user. Typical use cases include loan processing, compliance, regulatory reporting, capital optimization and risk analysis. By automating processes and leveraging data previously unexplored, clients spend less time and money on these tasks, freeing up their resources to tackle other work.

We share a few examples below.

Regulatory Compliance: A global bank saves time and money by automating the identification and triage of contracts impacted by a change in regulation

The Wholesale Banking Division of a multinational bank headquartered in Europe needed a quick, accurate and cost-effective way to identify credit agreements referencing the LIBOR interest rate benchmark that’s scheduled for retirement at the end of 2021. The bank’s back book extends to thousands of loans, and each agreement needed to be reviewed, which would take, on average, almost 70 minutes to complete manually.

A regulatory exercise like this would previously have involved a large team of highly skilled and highly paid in-house specialists or external consultants. On this scale, it would have been a prolonged and expensive exercise to carry out manually yielding somewhat inconsistent and error-prone results. The bank used Eigen’s Document AI technology to extract answers from all their loan documents to identify which ones needed remediation and their relative priority as well as the exact clauses that needed to be amended. The platform successfully extracted all the relevant information which amounted to 7,500 data points delivered in a spreadsheet to the Front Office team to inform their remediation plans.

The net result of using Eigen was a reduction in costs of 60% and a time saving of 75% as well as an increase in data quality compared to manual review efforts. Eigen’s team of Legal Product Consultants carried out the model development and training, so the bank’s teams could focus on other priorities. It’s worth noting that bigger cost savings could be realized by performing the machine learning model training in-house, a task easily done by non-technical users providing they are familiar with the documents and data requirements. The bank is now using Eigen to automate loan fulfillment processes, driving further efficiency gains and cost savings.

Loan Operations: A global investment firm closes new deals faster by automating analysis, data entry and cross-checking processes

The Operations team at a large, global investment firm was overwhelmed with the volume of new deals. Their manual processes were proving to be inefficient and scaling them to meet increased demand wasn’t cost-effective or desirable. The rigorous review procedures and the inconsistent nature of the paperwork meant that processing a single transaction could take many hours and involve several different people. The firm wanted to use AI to automate these processes but needed a solution that was easy to implement, maintain and use so they wouldn’t need internal IT support or in-house machine learning experience.

During an initial pilot project, the client trained Eigen’s machine learning model to accurately extract 50 key terms from a batch of 100 loan documents. The accuracy of the data compiled by the platform was on a par with levels attained by the team through manual review. Pleased with the results of the pilot and the platform’s ease of use, the firm has integrated Document AI into their workflow for processing new loans.

The efficiency gains using Eigen have been significant, reducing the average loan transaction processing time by two-thirds. The Eigen platform has enabled them to automate several processes, including document analysis, data entry, cross-checking and eliminating the need for multiple approval steps. The Operations and Treasury teams are now able to handle the busy periods around month-end as well as other peak times, closing deals faster to bring revenue in sooner. The firm is now piloting Eigen for a regulatory compliance use case, helping them to manage the document review process in-house so they can avoid the cost of hiring lawyers or consultants.

Capital Optimization: An insurer benefits from lower capital requirements by determining which bonds are eligible for relief using data automatically compiled

A global asset management firm managing assets on behalf of an insurance client wanted a scalable tech-led solution to determine which bonds within a pool of 1,000 were eligible for capital relief under Solvency II matching adjustment (MA) rules. They wanted to speed up the process of collating the relevant information to identify the assets meeting the MA criteria. This involved reviewing product prospectuses and associated publications to pull out the correct data on asset characteristics. They wanted a repeatable solution that leveraged the knowledge of experts and the power of AI.

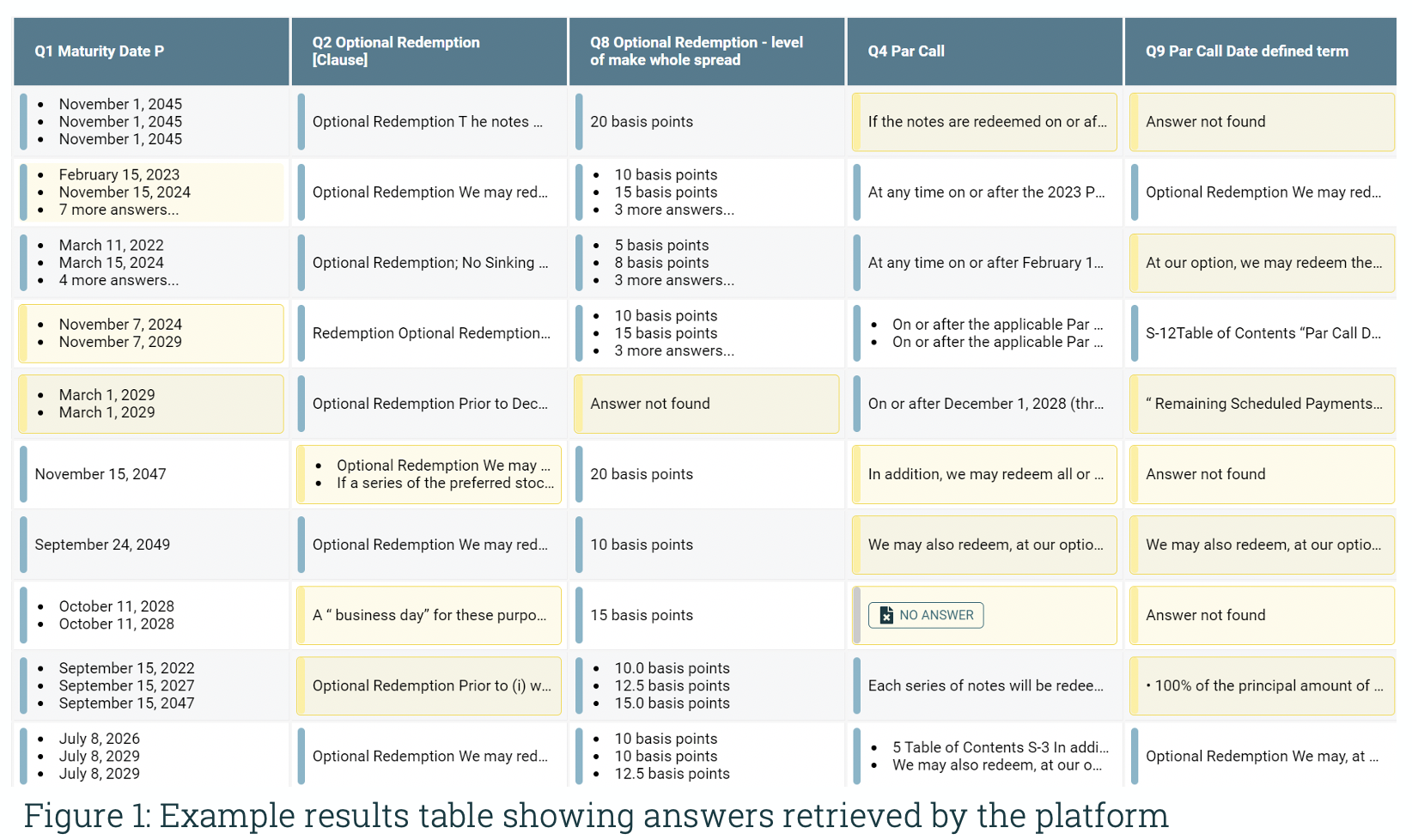

Applying MA is a complex process requiring the specialized knowledge of an actuary. The asset managers engaged a consulting firm to help them with their implementation project who partnered with Eigen to automate the assessment of eligibility for assets and compile the necessary data to demonstrate compliance as well as perform benefit calculations. The actuaries defined the information required to assess eligibility as well as the data required for the later stages of the process. They were able to quickly train the platform using a sample of documents to analyze their contents and pull out those that matched the eligibility criteria and extract the required data. In the diagram below, you can see an example of the results table showing the answers the platform retrieved as well as those requiring further attention by the actuary.

Using Eigen’s Document AI platform, 3,000 documents were analyzed during the initial implementation project, and the assessment of those eligible under MA rules was successfully automated. Additional data was compiled and exported for calculation and compliance purposes. Because the platform flagged instances when it was uncertain if it had found the right answer and those data points were reviewed, checked and corrected by an actuary the quality of the results were far higher than those typically achieved through manual review. The results were not only more accurate, but countless hours were saved in actuarial time required to complete the assessment. The end client, the insurer, is now able to claim capital relief. And the asset manager has leveraged the consultant's expert knowledge and captured that within the platform in a way that can be reused for other projects and clients in the future.

You can find more examples of client case studies here and more information about typical use cases here.

The Document AI future is now

The beauty of Document AI is its flexibility and scalability. There are almost a limitless number of processes, workflows and manual tasks involving document review and data compilation that the technology can automate or support. Is your team spending time manually reviewing documents? Or are you employing lawyers, consultants, analysts or temps to tell you what’s in your contracts? If so, it’s time to consider using Document AI.

In our next blog, we’ll explore what you need to know when selecting a Document AI provider that is right for your needs.

Are you wondering how Document AI can save your organization time and money?

Request a demo of our platform to find out how we can help you with your specific use case.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018