Unlocking ESG Data – the First Steps

The past five years have seen an increasing focus on issues of climate change and sustainability by central banks and financial regulators globally. There is now an acceptance and recognition by policymakers and legislators of the significant role that the financial system must play in the transition towards net-zero emissions. There has also been a growing recognition of the systemic risk posed by climate change, both to the global financial system and to individual economies, if the climate risk to which they are exposed should begin to crystallize. This would have a significant impact on asset values, particularly given the poor understanding of climate risk exposure across portfolios at present - and could result in a catastrophic collapse in asset prices.

An uncertain regulatory environment

Regulators are now applying the tools developed to tackle the global financial crisis to the problem of climate risk management and the development of green finance. Whilst many of these initiatives are still in draft form, there is little doubt that the industry is about to see a veritable tsunami of incoming ESG-related conduct and prudential requirements. These will also be accompanied by new reporting requirements enabling surveillance and supervision. In the meantime, many firms are caught in a limbo of uncertainty. What specific rules will apply to their business model? For those with a global presence, what will the cross-border and extraterritorial impacts of regulations be?

In practice, there is high variability in terms of individual financial institutions’ approaches to taking practical steps towards implementing sustainability in their financial services and activities. Accusations of greenwashing – real or imagined – are rife, and in this context, many firms have been slow to advance their plans as they may not know specifically what to do or may be concerned that early adoption will result in “getting it wrong” and attracting public criticism. And it’s not only about understanding new business and products and thinking about the investment strategy going forward – the back book of activity must also be analyzed and the impact of climate risk on the existing business must be assessed.

Data plays a vital role

Data plays a key role in both financing the transition and in demonstrably measuring the impact of the transition on asset values. Product-level sustainability data is vital – without it, it is impossible to assess climate risk exposure, to inform sustainable investment decisions, and to ensure that capital flows effectively to where it is needed. Product-level data includes the specific environmental impacts and outcomes of financial instruments such as equities, bonds, loans, and derivatives. The challenge lies in producing product-level data that is consistent, standardized, and usable. Ideally, it should one day be consumed as an input to pricing engines and risk management tools and form a component of the instrument-level market and static data that is so core to the financial services industry.

Laying the foundations of ESG data

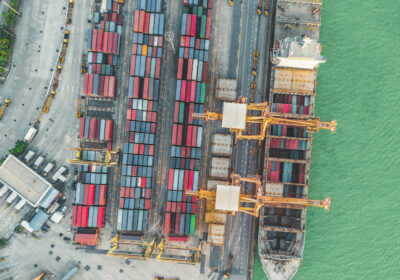

Regulators are laying the foundations for product-level sustainability data, with regulations such as the EU’s taxonomy for sustainable activities, the UK’s exploration of a green taxonomy to help tackle greenwashing, and, in the US, the SEC’s recent disclosures around mandatory climate disclosures. The private sector has taken up the baton in developing standards and best practices, and in promoting their take-up across the financial services industry. The Equator Principles and Poseidon Principles are aimed at enabling lenders and financing providers to understand the climate risk and impact of their financing activities on project finance and the maritime sector, respectively.

Global industry associations are increasingly taking the lead in further developing standards, frequently in collaboration with each other. The International Capital Markets Association (ICMA) and the Association for Financial Markets in Europe (AFME) collaborated to produce the Green Bond Principles, and undertake regular surveys on their update and performance as well. The International Swaps and Derivatives Association (ISDA) has undertaken a great deal of work on the definition and classification of ESG-related derivatives. ISDA’s work is particularly notable, as historically the standards it has produced for the derivatives market have ultimately gone on to be recognized as such by regulators.

Leveraging technology to unlock the value of data

These tools can be incorporated by financial institutions and issuers into the legal and contractual documentation that governs the financial instruments and trades into which they enter. In lieu of a clear regulatory framework, but also in anticipation of one, financial institutions need to begin implementing these industry-developed best practices, principles, and standards. This includes reviewing their contracts and documentation and taking proactive steps to incorporate the resulting data points into their decision-making processes.

Technology has a vital role to play. The data needed to measure sustainability impacts and assess risk must be extracted from both new and old contracts and documentation. It must then be transformed into meaningful metrics and reporting that can be used for decision-making across the organization. This is work that can and should begin today. With many firms having hundreds of thousands of such documents, this is not a job that can be done by humans, and firms will need to leverage the capabilities of technological advances in AI, machine learning and natural language processing (NLP) to take this next step forward.

Eigen’s AI-powered, intelligent document processing capabilities and platform provides firms with the ability to extract, classify and interpret virtually any information from any document to make smarter business decisions, eliminate manual processing and optimize data flow quickly and accurately. We continue to work with clients and industry participants to help them transition to ESG-centered financial markets.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018