Insuring Efficiency: Implementing Automation in Insurance

The insurance industry, known for its long, complex, and document-heavy processes, is an industry ripe for embracing digitization and automation. The gap between physical paper and digital documents has long hindered its progress. But today, artificial intelligence is transforming how businesses operate, and insurance is no exception.

According to Accenture, more than 75 percent of insurers plan to use AI to automate tasks in the next three years. AI will be a competitive differentiator for the organizations that adopt it.

In our webinar, Eigen's insurance experts used their respective experiences with digitization projects to break down the challenges inherent in automating insurance processes and discuss how you can overcome them to successfully adopt automation and digital transformation initiatives at your firm.

If you are one of the 75 percent of insurers who plan to embrace AI technologies sooner rather than later, read this webinar recap to learn how you can maximize revenue, reduce risk, and help your firm benefit from increased operational efficiencies.

The Challenges of Automation in Insurance

Before successfully implementing data and document automation solutions, it is important to understand the potential roadblocks. For the insurance industry, these challenges typically include:

- Complex Human Language: Insurance documents are rife with complex language and terminology. Understanding and extracting meaningful data from these documents requires advanced semantic processing and understanding.

- Insurance-Specific Language: The insurance industry has its own unique vocabulary and complex policy wording, making it challenging for standard automation tools to navigate.

- Data Extraction from Tables: Vital information in insurance documents is presented in tables, requiring not just natural language understanding but also computer vision capabilities for efficient extraction.

- Staying Technologically Current: As the insurance industry moves to adopt AI technology, it’s important to also manage change amongst internal stakeholders. By doing so you’ll save time and give yourself a competitive advantage. The challenge is getting the buy-in from the top down and leveling up skills to make the most out of automation. As we saw last year, preparing for AI adoption at scale was a huge trend — one that continues to be a key focus area for firms looking to stay ahead of their competition.

- User-Centric Approach: Often, technology solutions in insurance are developed without enough input from the end users, leading to avoidable inefficiencies that decrease user adoption.

Overcoming Automation Challenges in Insurance

To overcome these challenges and effectively implement automation in insurance to drive business efficiencies, it is important to consider the following:

- Blend Expertise: Marry domain-specific insurance expertise with technology fluency to solve real problems effectively.

- Engage Stakeholders: Ensure that the end users and business stakeholders are involved in the development process to align technology solutions with actual needs.

- Choose the Right Vendor: Select a vendor with deep insurance industry experience and a proven track record in solving complex insurance problems.

- Prioritize Business Problems: Focus on tackling business challenges that will have a significant impact on critical metrics like quote-to-bind ratio, submission-to-quote ratio, loss ratio, expense ratio, or combined ratio.

Eigen's Solution: Underwriter Assistant – Submission Triage

Every day thousands of incomplete or out-of-appetite insurance submissions are rejected around the world. What if there was a way to streamline this process so that only complete and in-appetite business was reviewed by your underwriting team?

Eigen’s AI-powered Underwriter Assistant tackles the submissions problem head-on. With Submission Triage, your underwriters can swiftly identify and prioritize submissions based on predefined business rules about what they can and cannot underwrite. Eigen helps your team automate repetitive, manual submission review processes while preserving the invaluable input they possess as the experts, recognizing that automation should enhance efficiency rather than replace the unique skills and judgment of your underwriters.

To see Eigen’s Submission Triage solution in action, watch here.

Your Use Case

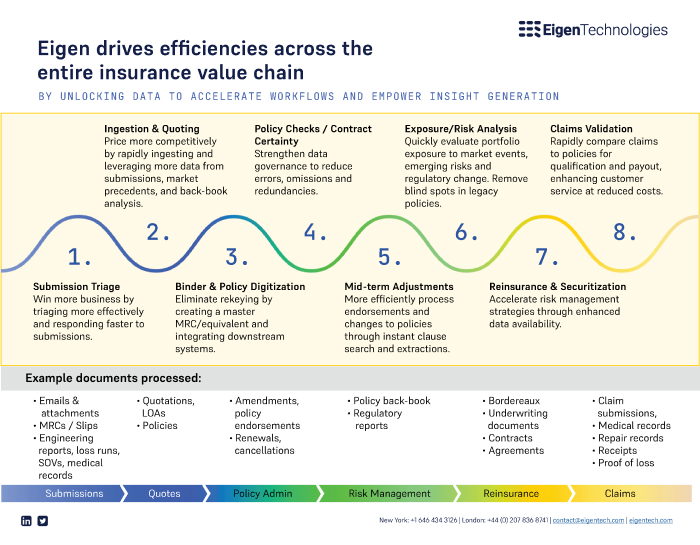

Given how far technology has come, there are plenty of processes and areas within insurance that would benefit from automation. If you are looking at digital transformation and where to begin your automation journey, here are the eight key areas where automation can bring significant improvements.

Of course, these are just some starting points. If you have a specific use case or if you are interested in learning more about what Eigen can do for your business, request a call with one of our automation specialists today.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018