Arbitrage opportunities and market risks for credit and ABS players following the IBA LIBOR announcement on November 30

Following the ICE Benchmark Administration (IBA) announcement on November 30, there has been much reflection by asset managers and credit funds on how to reorganize their LIBOR transition programs. At initial glance, it does indeed take the pressure off buy-side firms, particularly those who’ve been struggling to get to grips with their transition plans.

LIBOR transition buy-side trends we’re seeing

From our conversations with market participants, we’ve noted five key trends:

- As of Q4-2020, most buy-side firms had not started their LIBOR transition programs and were therefore under significant time pressure to meet the December 2021 deadline

- The SEC letter on LIBOR preparedness in June has added further pressure to US buy-side firms and is an area of concern

- Many buy-side firms do not have the infrastructure or internal resources to handle the transition and require expensive external legal support

- Uncertainty around the spread, especially relating to cost of funding and how this impacts the asset/liability matching in CLOs

- A general feeling of inertia given that buy-side firms are ‘not in the driving seat’ and have more pressing needs like COVID default risks and general market volatility.

Market impact of IBA November announcement

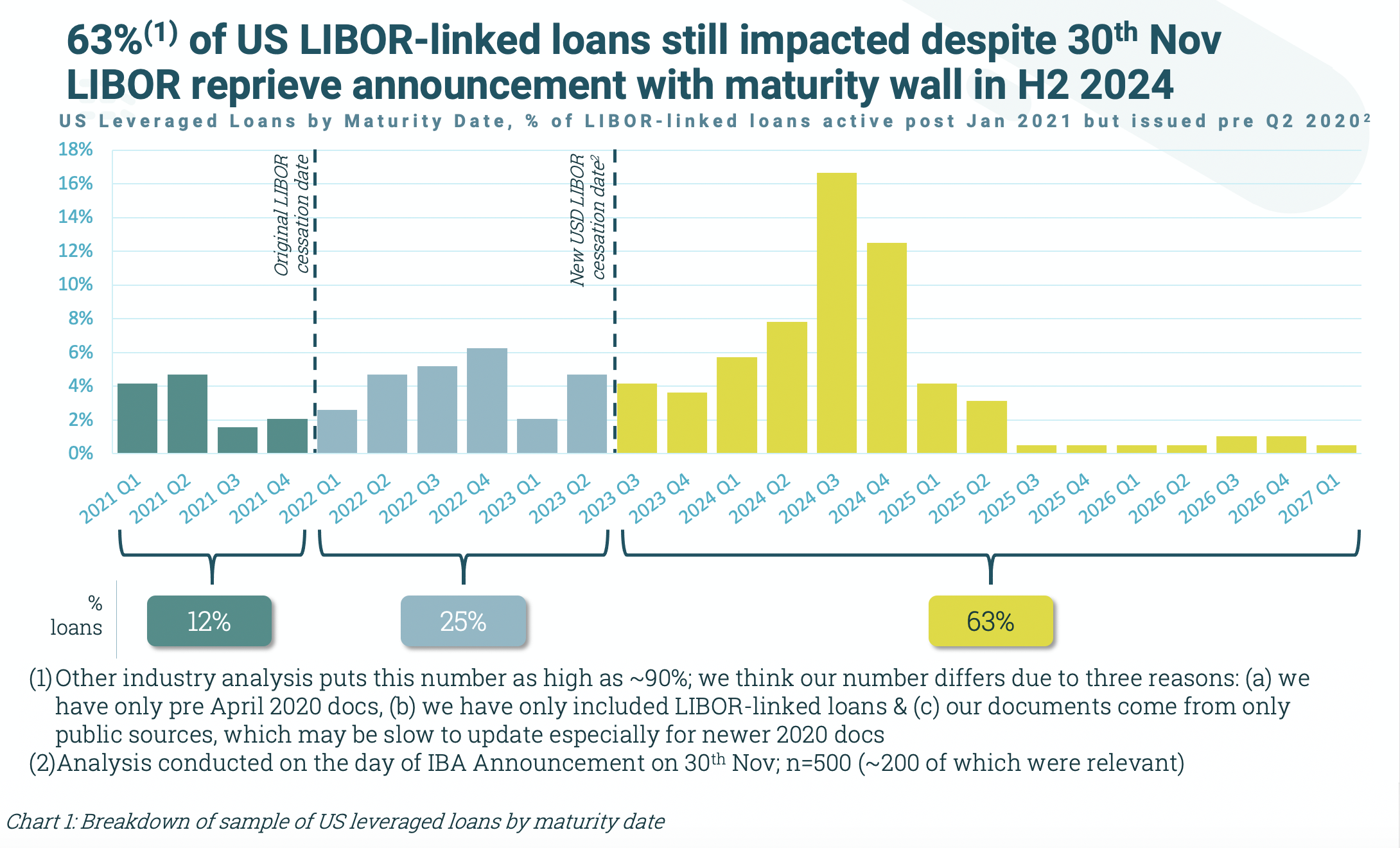

Within hours of the IBA announcement on November 30, we had analyzed 500 public LSTA-style US loans using the Eigen no-code AI platform. This rapid assessment enabled us to determine that:

- 25% of the loans sampled had a maturity date between Q1-2022 and Q2-2023 and would be mitigated by the extended deadline

- Circa 60% of active LIBOR-linked LSTA-style loans have a maturity date post-July 1, 2023 and will therefore still need to be remediated under the newly proposed timelines. The LSTA’s own analysis referencing S&P data showed this number to be closer to 90%.

As we discussed in our blog on December 1, there are known reasons for this discrepancy, as shown in the chart below. Nonetheless, with 60-90% of loans still needing to be remediated the scale of effort across the industry is still significant and should not be underestimated.

While the IBA announcement offers some reprieve on timings for USD-linked LIBOR instruments, we have talked to many industry participants and clients who have indicated that it creates some additional operational challenges. Back from the holidays, many of those in the asset management space are now focused on their LIBOR transition more than ever.

Complexity arising from IBA announcement

The problem remains for direct lenders, even if those loans that mature between January 2022 and June 2023 no longer need to be remediated. For CLO managers, and other types of structured product managers, the situation has been made potentially more complex for three reasons:

-

Asset/liability spread mismatch: Ahead of the November 30 announcement, there was already a risk that the CLO fallback language and the fallback language of the underlying loans could differ, causing a divergence in the underlying spreads of the structured product versus its underlying collateral. However, this was somewhat mitigated because there was a consensus in the documentation around LIBOR cessation date being December 31, 2021. Before the announcement, all the fallback language contemplated a single cessation date providing an important level of consistency. Following the November 30 announcement, some loans could continue with LIBOR after December 2021, but some loans would have hard fallbacks requiring them to switch to another risk-free rate (RFR) regardless. The divergence in timing will potentially introduce increased risk and inconsistency within a CLO.

-

New LIBOR issuances: In the latest guidance, LIBOR instruments can continue to be issued in 2021 so newly issued instruments will need to be checked to see if they contain standard ARRC language and to determine if the language has a transition date of December 2021 or June 2023. Again, this creates the need for additional document checks and increases the risk of divergence. Furthermore, with the cessation date for USD LIBOR pushed back, the urgency in the market for transitioning new issuances to a new RFR has diminished.

-

Operational market divergence: LIBOR transition progress and preparedness differ significantly institution-by-institution with some firms completing their back book review as early as Q1-2020 while others are yet to start planning. The extended timeline for USD LIBOR cessation will cause even further divergence in participants’ readiness impacting expectations, product offering and negotiation positions across the market.

Mitigating the risks and creating opportunities

For a collateral manager, there may be situations where you want to change the fallback language (for example, to extend LIBOR to 2023 for CLO tranches). Still many documents are drafted such that it requires a large proportion of noteholders or equity holders to agree. Given point number 1 above on asset/liability spread mismatch, they may be disincentivized or will even attempt to game the structure.

On the flip side, as an investor in CLO tranches, understanding the complexities above may also provide ways to game the structure in holding positions or in renegotiation as noteholders, potentially generating gains. By understanding the language in the structured product offering memorandums and underlying loan/collateral documents, buy-side firms can mitigate risk and even generate arbitrage from the situation. This is key for CLO traders and investors. Most CLOs in the secondary market have LIBOR references and traders still need to process these secondaries. An assessment of LIBOR language needs to be part of their risk/return profile and this needs to be done quickly. Hence, using Document AI to quickly assess LIBOR risk is even more important following the IBA announcement.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018