Assessing the impact of the IBA’s announcement on LIBOR

On November 30, the ICE Benchmark Administration (IBA), who compiles and oversees LIBOR, announced that subject to consultation it will extend the publication of USD LIBOR benchmarks until June 30, 2023 for all but the one-week and two-month tenors.

The cessation of USD LIBOR, which underpins around USD 200 trillion worth of active contracts, presents a massive undertaking for banks and financial services firms who need to analyze all their legacy documents to identify those that reference the benchmark. A range of actions including repapering, renegotiation and wind-down then need to be taken based on the maturity date, LIBOR tenor, currency and fallback provisions contained within each document.

This latest announcement from the IBA is seemingly good news for banks and firms dealing with the cessation of LIBOR amidst the pandemic and the economic fallout it’s created. However, it also adds further complexity to an already challenging exercise. As the scope of what’s required, and when, changes so too must the analysis that supports the transition effort. And what is the real upside in terms of the reduction of contracts requiring remediation under these newly proposed timelines?

At Eigen, we’ve successfully developed an out-of-the-box warmed-up LIBOR machine learning model with our Document AI technology that enables clients such as ING to quickly and cost-effectively perform legacy document analysis in-house. Our warmed-up model supports a wide range of document types extracting qualitative and quantitative data points required for LIBOR transition as well as answering commonly asked questions related to linked provisions.

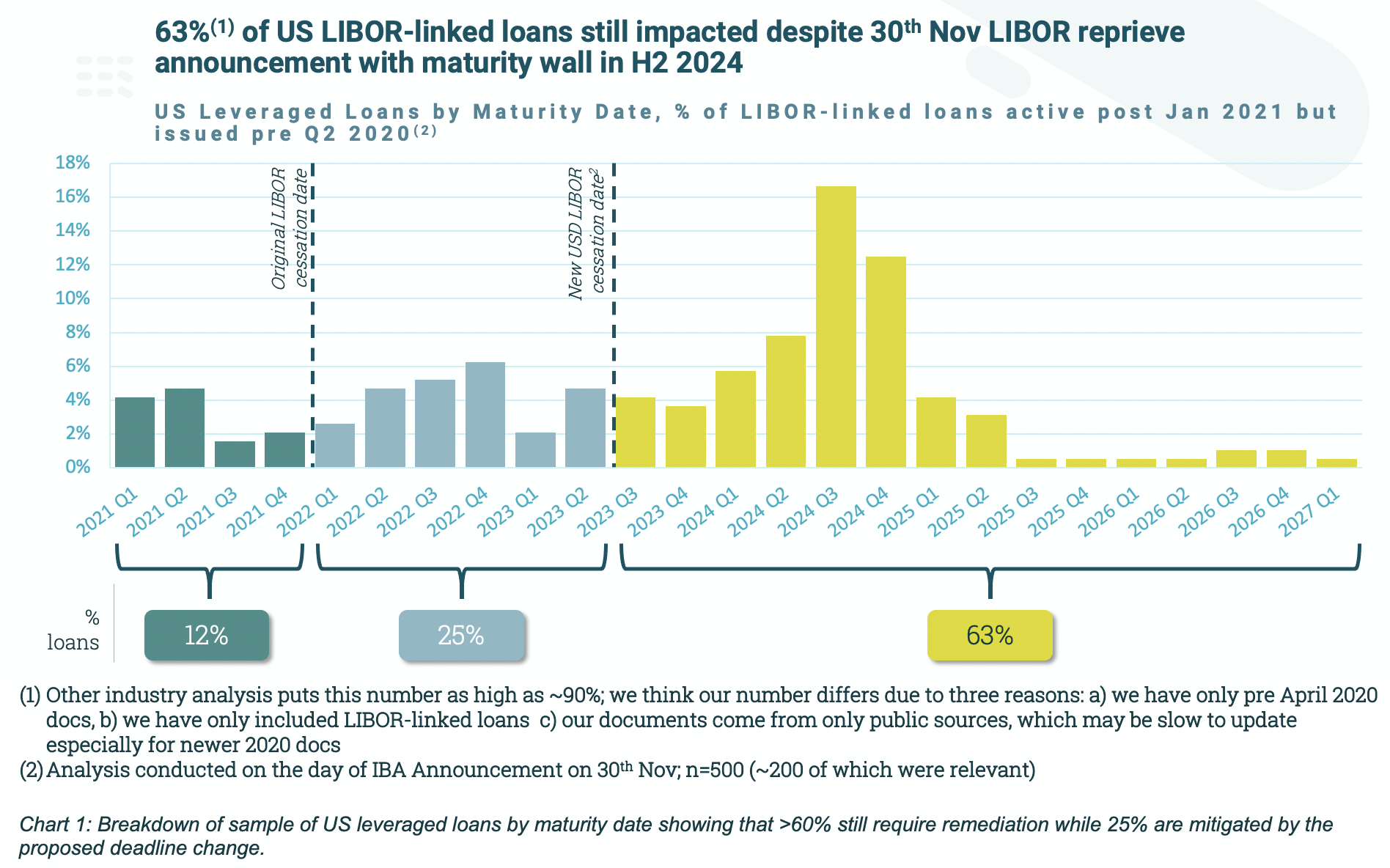

Using both our warmed-up model and also training new questions to deal with the nuances of LIBOR tenor on the day of the announcement, we were able to assess the impact of the IBA’s announcement in under 10 hours by uploading a random sample of 500 public LSTA-style US loans to the Document AI platform and letting it analyze their contents. The platform extracted and interpreted information related to maturity dates and LIBOR tenors. This rapid assessment enabled us to determine, based on our sample, that:

- More than 60% of active LIBOR-linked LSTA-style loans have a maturity date post-July 1, 2023 and will therefore still need to be remediated under the newly proposed timelines.

- 25% of the loans sampled had a maturity date between Q1-2022 and Q2-2023 and would be mitigated by the extended deadline should it come into effect.

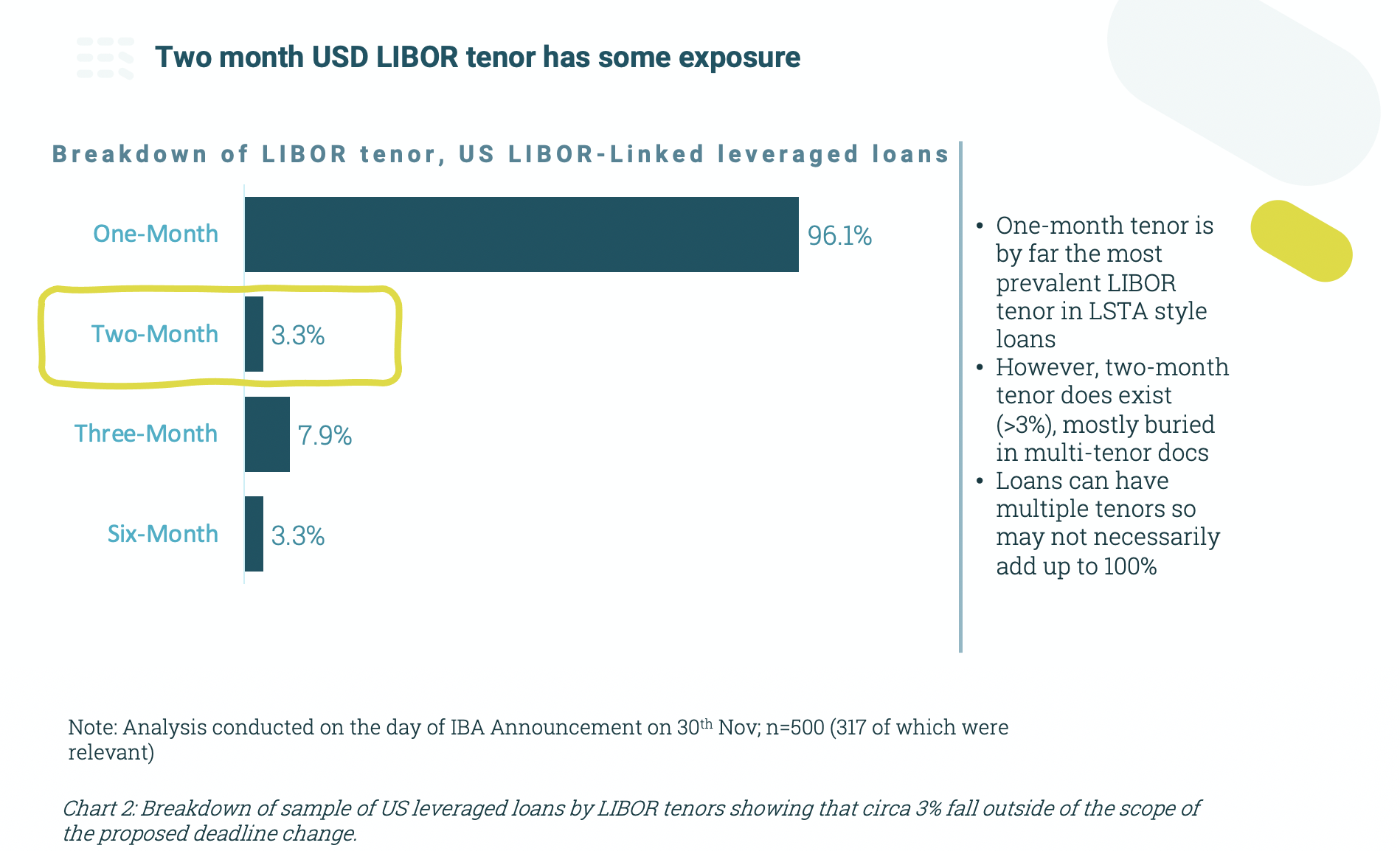

- 3% of the loans referenced the two-month LIBOR tenor and therefore fall outside of the scope of this proposed deadline change.

In the charts below, you can see the breakdown of the 500 active LSTA loans by maturity date (chart one) and LIBOR tenor (chart two).

With our flexible Document AI platform and warmed-up model for LIBOR, it's possible to quickly analyze your legacy back book or flow book. The flexibility also allows for rapid response and assessment based on changing market conditions such as this most recent announcement. The model leverages our knowledge of the frequently asked questions, amassed from working on over 14 LIBOR transition projects for G-SIBs, national banks, asset managers and hedge funds over the last two years. The user-friendly platform means non-technical users can easily upload documents and extract data without any previous machine learning experience.

Let us show you how we can help your firm with its LIBOR legacy document analysis. Send us a handful of your LSTA documents, and we’ll run them through our warmed-up model and send back the extracted data within 24hrs. Please email us at [email protected] to take us up on this offer.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018