Savings, Speed, and Simplicity: How Banks can Automate Loan Processing with AI

In the ever-evolving world of lending, maintaining efficient loan operations are crucial for success. Traditional lending processes involve numerous manual tasks including document processing and data entry, which often leads to processing delays, errors or increased operational costs. Intelligent automation platforms, like Eigen, can be leveraged to tackle these challenges.

Eigen's customizable, no-code AI platform uses machine learning to automate the extraction of valuable information from diverse, structured and unstructured loan documents to help your firm accurately process more loans than ever before.

In this blog, we'll explain how Eigen's platform can automate and accelerate processes throughout the loan lifecycle.

Overview of the Loan Lifecycle

The loan lifecycle encompasses a series of stages that include loan origination, due diligence, onboarding, servicing, monitoring and portfolio sales. From underwriting and pricing loans to negotiating loan terms and executing loan agreements, loan documents and the data points within them play a pivotal role. Oftentimes, loan data needs to be integrated with other systems, like Contract Lifecycle Management (CLM) systems, and ensuring the accuracy of the data used throughout this complex process is essential.

What are the common pain points in loan operations?

Loan operations personnel, particularly those in middle and back offices, face numerous challenges due to manual and error-prone processes.

Three of the most common pain points felt in loan operations are:

- Efficiency Bottlenecks: Manual processes result in slower loan processing times, leading to delays in generating interest, income and fees. Rekeying data and a lack of systematic controls can also impede overall efficiency.

- Difficulties Mitigating Risk: Compliance and data quality are paramount in loan operations. Manual data entry increases the risk of errors, while a lack of systematic controls can result in compromised data quality.

- Maintaining Customer Satisfaction: In a competitive landscape, customers expect faster loan approvals and disbursements. Slow, manual processes cannot compete with those that are automated, and when client lead times go up, so does their dissatisfaction.

Moreover, the rise of fintech companies offering streamlined and more technologically advanced lending processes to clients poses a threat to traditional banks. To remain competitive, banks must transform their loan operations by embracing technology-driven solutions.

How Eigen adds value throughout the loan lifecycle

Eigen's platform seamlessly integrates across your loan operations workflow, automating the extraction of information from financial statements and commercial loan agreements. Eigen's machine learning models easily extract data from tables and the cells that comprise them, ensuring the data transferred to your credit underwriting systems, CLMs and other internal databases happens quickly and accurately. Additionally, Eigen's Global Review Hub gives your teams the ability to audit extracted data, remediate missing or inaccurate information, flag items for management review and much more.

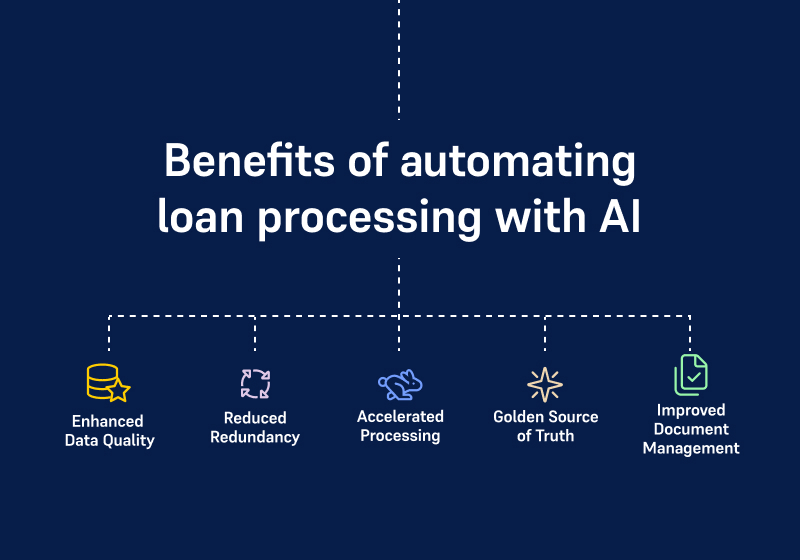

Financial institutions leveraging intelligent automation technologies, like Eigen, for loan processes benefit from:

- Enhanced Data Quality: Using artificial intelligence and machine learning, Eigen's platform ensures significant improvements in data quality. Documents and data are analyzed according to configurable rule sets, ensuring your processes are consistent.

- Reduced Redundancy: Automation minimizes data duplication and reconciliation issues, which means you get more accurate and reliable data.

- Accelerated Processing: The amount of data you can straight-through process is significantly enhanced, reducing the time required for various steps in your loan workflows. This efficiency helps you remain competitive in the world of lending.

- Having a Golden Source of Truth: Eigen's platform establishes a single, reliable source of data truth, eliminating ambiguity and data integrity concerns.

- Improved Document Management: Intelligent automation assists in organizing document repositories by establishing parent-child relationships and enforcing document terms, making it easier to manage and locate information across your documents.

Eigen's intelligent automation platform enables banks and financial institutions to overcome operational challenges, improve efficiency, reduce errors and streamline workflows. By combining human expertise with AI and machine learning, Eigen augments decision-making processes, ensuring faster and more accurate outcomes. In today's dynamic lending landscape, Eigen's platform is a powerful tool for achieving operational excellence while meeting the evolving needs of customers and regulatory requirements.

If you would like to see how Eigen can help you automate and accelerate your loan processes, request a custom demo on your own loan documents or credit agreements today.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018