Revolutionizing ISDA Processes with Eigen's ISDA Pack

We know that 80-90% of essential business data resides in unstructured documents. But before delving into how Eigen's ISDA Pack transforms ISDA documents and processes for major banks, it's important to understand Eigen's core mission: make data useful. We strive to extract important data from lengthy complex financial documents and transform it into structured data that can power your downstream systems, reporting, and decision-making.

The Challenges of ISDAs

ISDAs, with their sheer size and complexity, pose a unique set of challenges:

- Locating and Gathering Documents: The ISDA family of documents is extremely diverse. In addition, many rounds of edits and amendments can be added, which makes it difficult to gather and organize the right documents.

- Poor Data Quality and Missing Document Metadata: Data quality and document metadata can often be lacking, making it challenging to extract meaningful information.

- Manual Data Extraction: Many organizations rely on the manual extraction of data, which is a time-consuming and error-prone process.

- Identifying Enforceable Terms: Recognizing the correct and current enforceable terms within ISDAs can be challenging.

- Handling Umbrella/Fund Level Agreements: The complexity of umbrella and fund-level agreements adds an additional layer of intricacy.

The current derivatives contracting process is predominantly manual, relying on paper-based documentation and wet-ink signatures. This manual approach leads to inconsistencies in legal data representation across contracts and systems, resulting in a high percentage of legal disputes, particularly in collateral-related matters. The banking industry has been slow to embrace Artifical Intelligence (AI) and machine learning tools, which leaves organizations reliant on traditional expensive, error-prone manual processes.

AI to the Rescue

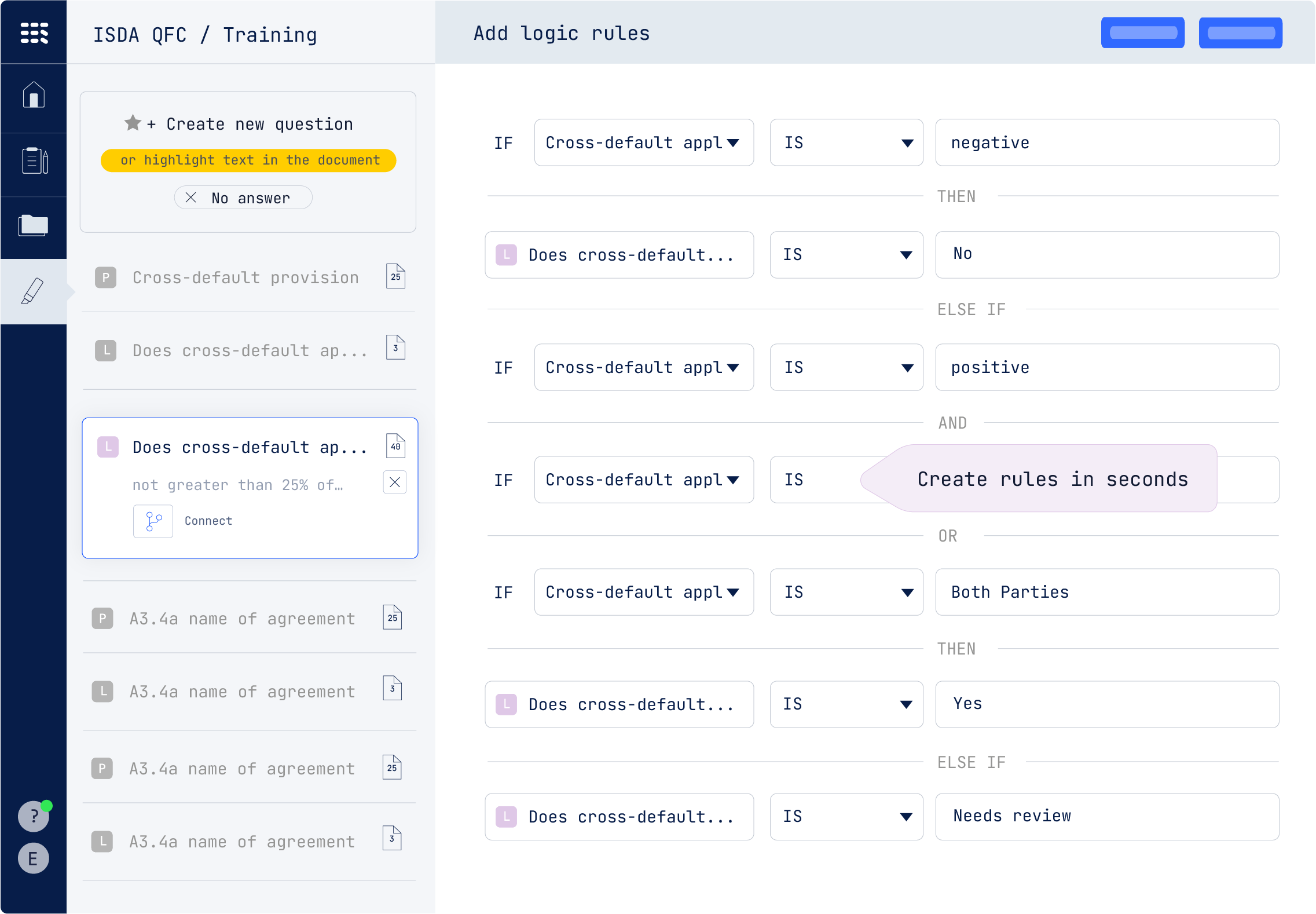

From years of experience serving diverse clients, we’ve created the ISDA Digitization Pack: a pre-trained AI model built to extract more than 100+ of the most common data fields across the ISDA family of documents — ISDA master agreements, schedules, and CSAs. This toolkit simplifies the handling, reading, and transforming of ISDA documents with precision and accuracy.

You can view the ISDA pre-trained fields here.

Real World Use Case: Termination Events. When it comes to identifying changes in control, credit ratings or downgrades, Eigen can quickly identify enforceable terms, significantly improving process efficiency. Furthermore, Eigen's unparalleled ability to extract data from tables, such as collateral tables, enhances the speed and accuracy from which you can extract data.

Eigen operates in a highly regulated financial environment and employs "human in the loop" tools to ensure 90-95% accuracy requirements are met, bolstering confidence in the process while maintaining enterprise-level efficiency.

92% Straight-Through Processing for Goldman Sachs

Our pre-trained ISDA models are not theoretical; they've been effectively applied in real-world scenarios. For instance, Goldman Sachs uses Eigen to seamlessly process 92% of QFC reports from the source to the SEC, with a remarkable 99.7% accuracy rating on fields that are straight-through processed. For a significant portion of documents, no human intervention is required. For the remaining 8%, where confidence is slightly lower, human review steps are added to confirm data accuracy.

This approach has resulted in substantial operational improvements for clients including cost and risk reduction, faster regulatory compliance, and other competitive advantages.

Interested in seeing how you can easily automate the extraction of data from ISDAs?

Or you can request a custom demo using your ISDA documents here.

-

World Economic forum 2020

-

Gartner Cool Vendor 2020

-

AI 100 2021

-

Lazard T100

-

FT Intelligent Business 2019

-

FT Intelligent Business 2020

-

CogX Awards 2019

-

CogX Awards 2021

-

Ai BreakThrough Award 2022

-

CogX Awards Best AI Product in Insurance

-

FStech 2023 awards shortlisted

-

ISO27001

-

ISO22301

-

ISO27701

-

ISO27017

-

ISO27018